To empower youth and adults economically, from low income

communities by teaching and stressing the life long importance of financial literacy.

Budgeting

We teach your children to create a plan to spend their money wisely which is an important skill at any age.

Generational Wealth

We offer the tools needed to build and maintain generational wealth.

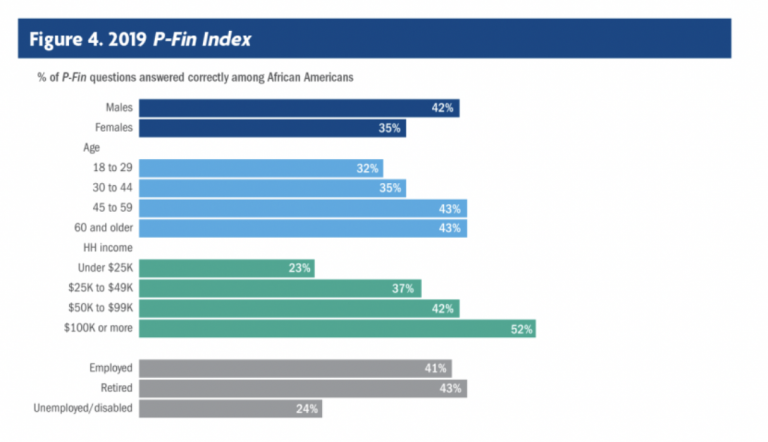

Investing

Risk vs. reward, stocks and bonds, and profits and losses; we teach kids all about it here at About The Money.

Early Education

Teaching financial literacy before adulthood greatly increases the chance of your child being able to correctly manage their finances as an adult.

Fiscal Responsibility

Graduates of our programs will know what to do and what not to do when it comes to managing their finances. They will have a plethora of tools at their disposal to help increase and maintain their financial literacy.

Lifetime Lessons

The lessons children learn at About The Money will be lessons that will stick with them for a lifetime. They’ll be able to invest and grow their finances from high yield savings to retirement accounts. They’ll know the difference between stocks and bonds and be able to understand what it means to reinvest dividends, implement dollar cost averaging and create a budget.

Featured Classes

Improving Your

Credit Score

Credit Card Management for

College Students

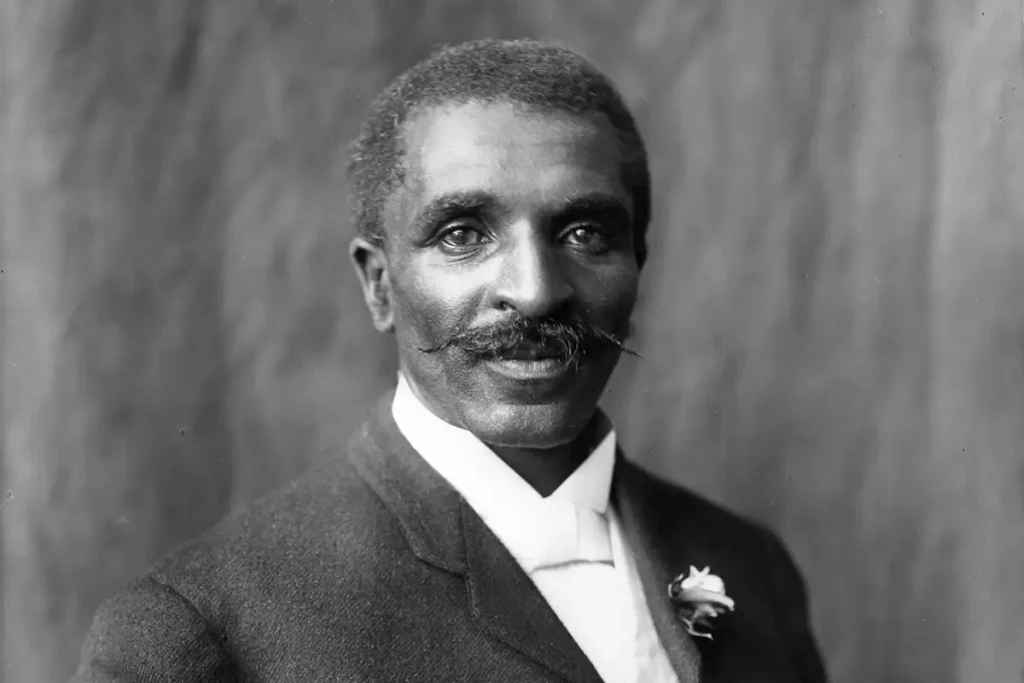

“No individual has any right to come into the world and go out of it without leaving behind him distinct and legitimate reasons for having passed through it.”

– George Washington Carver